Michigan Chamber of Commerce issued the following announcement on July 8.

The Michigan Chamber is extremely disappointed that Governor Whitmer vetoed Chamber led legislation to give taxpayers an estimated $1 billion in property tax relief.

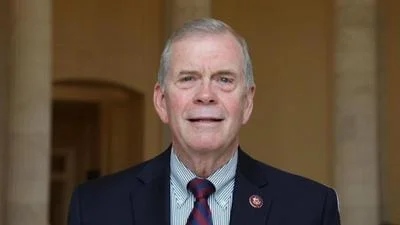

HB 5761 and HB 5810 introduced by Representative Jim Lower would have provided an extension to pay the upcoming summer property tax levy for both businesses and individuals negatively impacted by state mandated shut down orders or the recent flooding in the Midland area. Businesses that have not been open or severely restricted in their operations will not have the cash on hand to pay this significant expense. Without the relief this legislation provides, more businesses will close, and our economic recovery will be greatly delayed.

A simple extension to pay these taxes would have been a commonsense solution to a major problem. The bills were approved with unanimous support in the House and with strong bipartisan support in the Senate. Only 4 no votes were cast throughout the entire process.

The problems with the legislation cited in the Governor’s veto letter were not raised until after the bills passed and could have been rectified in follow up legislation. The fact that the Governor claims local governments found this much needed relief too complicated to administer is insulting. Nothing about running a business these days is not complicated. Creative solutions take effort on both taxpayers and tax collectors. The constitutional issues raised could have been fixed in follow up legislation. Workgroups were already meeting to resolve any outstanding issues raised after passage.

Original source can be found here.

Source: Michigan Chamber of Commerce

Alerts Sign-up

Alerts Sign-up